In today’s fast-paced world, convenience and efficiency are paramount when it comes to financial transactions. As we transition further into the digital age, mobile wallets have become increasingly popular, and one name that stands out in the Indian market is “JioMoney.” In this article, we will take a comprehensive look at JioMoney, its features, benefits, and how it has revolutionized the way we handle our finances.

Table of Contents

- Introduction

- What is JioMoney?

- Setting Up Your JioMoney Account

- Loading Funds into Your Wallet

- Making Payments with JioMoney

- JioMoney for Bill Payments

- Recharge and Top-Up

- JioMoney Security Measures

- Special Features and Offers

- JioMoney Merchant Services

- JioMoney App User Interface

- Benefits of Using JioMoney

- Comparison with Other Mobile Wallets

- Customer Support and Assistance

- Conclusion

Introduction

In a world where digital transactions are the norm, JioMoney emerges as a trusted and efficient mobile wallet solution. Developed by Reliance Jio, one of India’s leading telecom companies, JioMoney offers a seamless and secure way to handle your financial transactions.

What is JioMoney?

JioMoney is a mobile wallet application that allows users to store money digitally and conduct various financial transactions through their smartphones. It is designed to make payments, bill payments, recharges, and online shopping hassle-free.

Setting Up Your JioMoney Account

Getting started with JioMoney is a breeze. Simply download the app from your app store, follow the registration process, and link your mobile number to create an account. Once you’ve completed the setup, you’re ready to explore the world of digital transactions.

Loading Funds into Your Wallet

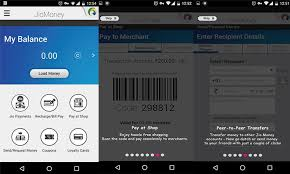

To use JioMoney, you need to load funds into your wallet. You can do this by linking your bank account, debit card, or credit card to your JioMoney account. Once your wallet is funded, you can start making payments and transactions immediately.

Making Payments with JioMoney

JioMoney allows you to make payments at various online and offline merchants, including retail stores, restaurants, and e-commerce websites. With just a few taps on your smartphone, you can complete your transactions swiftly and securely.

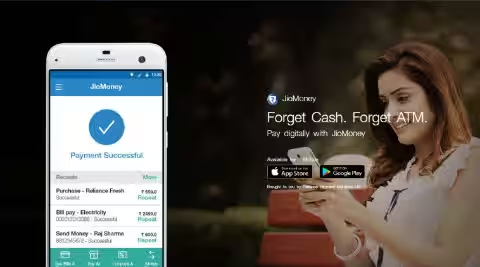

JioMoney for Bill Payments

One of the standout features of JioMoney is its utility for bill payments. You can pay your electricity, water, gas, and broadband bills with ease. The app also offers reminders to help you avoid late payments.

Recharge and Top-Up

Need to recharge your mobile phone or DTH service? JioMoney simplifies this process by offering quick and convenient recharge options. You can also top up your Jio prepaid connection hassle-free.

JioMoney Security Measures

Security is a top priority for JioMoney. The app employs robust security measures to protect your financial data and transactions. Your personal information is encrypted, and transactions are secured with multi-factor authentication.

Special Features and Offers

JioMoney regularly provides special offers, discounts, and cashback deals to its users. This makes it an attractive option for those looking to save money while making digital payments.

JioMoney Merchant Services

For merchants, JioMoney offers a range of services to accept digital payments. Whether you run a small business or a large establishment, JioMoney can simplify your payment processes.

JioMoney App User Interface

The user-friendly interface of the JioMoney app ensures that users of all tech-savviness levels can navigate it effortlessly. The intuitive design enhances the overall user experience.

Benefits of Using JioMoney

- Convenience: JioMoney eliminates the need to carry cash or cards, making transactions more convenient.

- Offers and Rewards: Users can enjoy exclusive discounts and rewards when using JioMoney for payments.

- Bill Reminders: The app sends timely reminders to help you keep track of your bill payments.

- Security: JioMoney employs state-of-the-art security measures to protect your financial information.

- Merchant Services: For businesses, JioMoney offers an efficient way to accept digital payments.

Comparison with Other Mobile Wallets

JioMoney stands out due to its seamless integration with the Jio ecosystem and its wide range of services. However, users should explore different mobile wallets to find the one that best suits their needs.

Customer Support and Assistance

Should you encounter any issues or have questions regarding JioMoney, their customer support is readily available to assist you. You can reach out for help via the app or their official website.

Conclusion

In conclusion, JioMoney is more than just a mobile wallet; it’s a financial companion that simplifies your life. Its user-friendly interface, robust security measures, and array of services make it a top choice for digital transactions in India. So, why wait? Make the switch to JioMoney today and experience the future of seamless financial transactions.